This a guest post by Emma worden, see Emma’s details at the end of the article

The basics of taking control of the money in your business

It seems like more and more Aussies decide to give entrepreneurship a go. In fact, according to the most recent studies, there are 2.1 million small businesses in the country and this number is expected to grow even more. However, running a small business isn’t as easy as it may seem, especially when it comes to managing finances. So, if you’ve ditched your 9-to-5 job and started your own small business, you could use any help you can get. And that’s why we came up with 10 tips for better financial management in your business.

Don’t mix personal and business finances

One of the biggest mistakes rookie entrepreneurs make is failing to separate their personal and business finances. This leaves them not knowing how well their business is doing and whether some changes in their operations should be made. So, if you want to be able to manage your company’s finances effectively, keeping a separate business bank account is an absolute must.

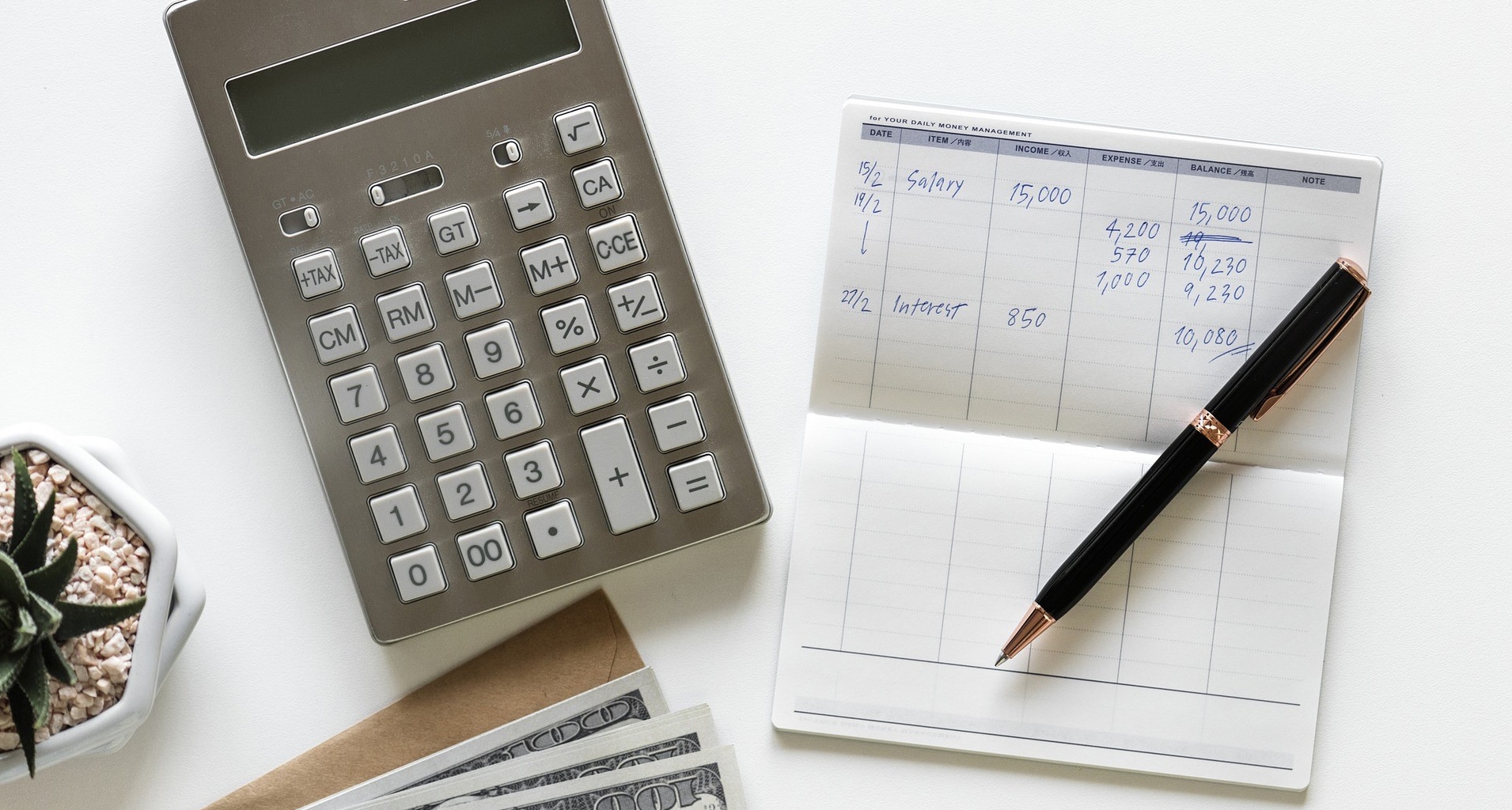

Manage your accounting

There’s no need to say that accounting is one of the most important aspects of being an entrepreneur. If this is your first time running a small business, chances are you don’t know much about accounting. In a scenario like this, hiring a good bookkeeper can be a real lifesaver. If you decide to tackle accounting yourself, investing in an accounting software can turn out to be an amazing idea.

Be aware of your day-to-day costs

No matter what kind of small business you’re running, you can’t survive in the market if you don’t have enough money to cover all of your day-to-day costs. We’re talking about costs such as your rent, wages and office supplies. Therefore, you need to be aware of how much money your business needs in order to keep operating and make sure you don’t go below this.

Know how to deal with taxes

If you want to be able to manage your company’s finances effectively, you also need to know how to deal with taxes. If you’re a small business with a turnover of less than $10 million, the company tax rate you’ll have to cover in currently 27.5%. Make sure you meet all the deadlines for filing tax returns in order to avoid fines and interest.

Apply for a loan on time

There’s no reason for you to wait too long before you apply for a loan that’ll help you grow your business. In fact, if you wait until your company is in a bad financial position to apply for a loan, chances are you won’t be able to receive financing at all. Therefore, make sure you turn to a company that gives fast business loans while your finances are still good.

Create an emergency account

You never know when things can go wrong, and having some money stashed away can be a real lifesaver. The best way to do this is to create an emergency account and move a portion of your monthly earnings to that account. The money you set aside can help you cover payroll during a slow season or allow you to replace equipment that broke down.

Collect your invoices

If you want your business to survive, you have to make sure you maintain a healthy cash flow. And this is something you won’t be able to do if your clients are late on their payments. The best way to deal with such clients is to hire experts in invoice collection. There are plenty of invoice collectors in Australia and finding a company you can turn to shouldn’t be too difficult.

Protect your data

Another important thing to have in mind if you want to avoid financial hiccups is that you need to protect all of your company’s data. This is the case because new mandatory data breach reporting laws came into effect in Australia. According to these laws, you could face a large fine in case an unauthorized entity comes accesses anyone’s personal information from your business computer system.

Don’t spend prematurely

One of the biggest mistakes you simply have to avoid is spending prematurely. This means that you shouldn’t go big on marketing, business cards and inventory until you’re 100% sure your business has what it takes to succeed. Spending too much on things like this can create a cash flow blockage, which is definitely something you need to avoid.

Remain frugal

When running your own business, it’s quite easy to get sucked up in the benefits of business ownership. However, if your business is still in its early days, you probably can’t afford this just yet. Instead, what you need to do is set your salary as low as possible in order to save money you can spend on improving your company’s operations.

Have these 10 tips in mind and you might just manage to follow the steps of many Aussies out there and start a successful small business. Just bear in mind that even once you establish yourself on the market, looking for new ways to improve your money management is critical.

Cashflow, Profit and the 7 Big Questions of Small Business

Business owners frequently ask 7 Big Questions about how to Build a Beautiful Business and Life.

The second of the 7 Big Questions is: How do I make more money in my business?

To answer the second question, I have identified the “7 Rules for making more Profit in business.”

The fourth Rule is the old maxim: Cashflow is King. This is one of many more articles on this site that explain how Cash and Profit hang together, in some depth.

Download my 12 Question Cheat-sheet to help you find your next Coach.

Guest Post

Emma Worden is a business manager from Sydney. She enjoys reading and writing on a business topic and giving advice and tips through her texts. If you want to read more of her work, you can find it at https://bizzmarkblog.com/

Thank you very much nice information & tips by Bizbilla